Personal Income Tax Rates Canada 1960

The rates assume that british columbia will enact its proposed new top bc income tax rate of 20 5 on taxable income exceeding cad 220 000 starting 1 january 2020.

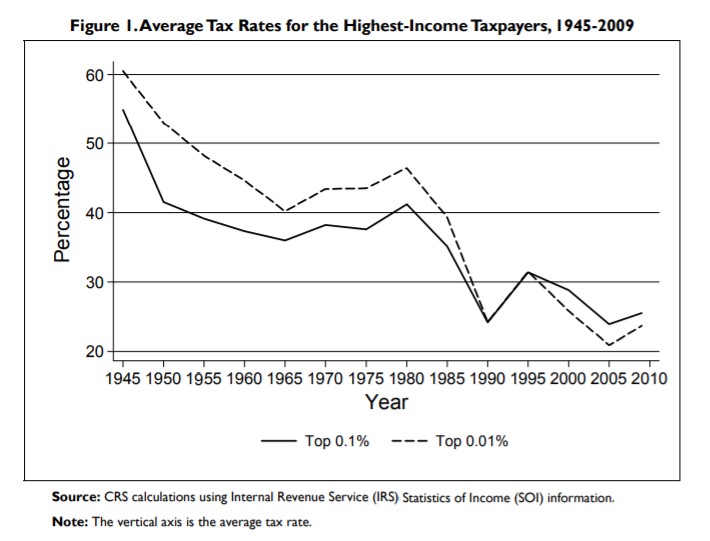

Personal income tax rates canada 1960. The top marginal tax rate in 1960 was 91 which applied to income over 200 000 for single filers or 400 000 for married filers thresholds which correspond to approximately 1 5 million and 3 million respectively in today s dollars. Personal income tax rates. As revealed by a toronto star corporate knights investigation canadian companies have used complex.

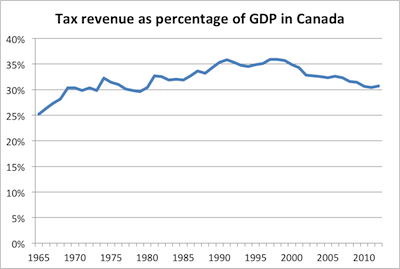

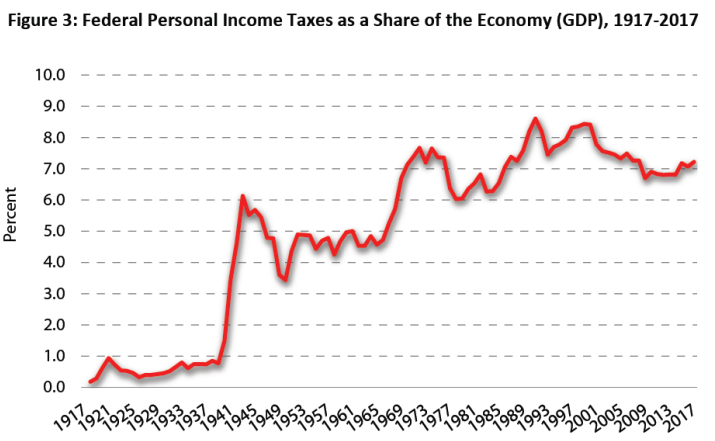

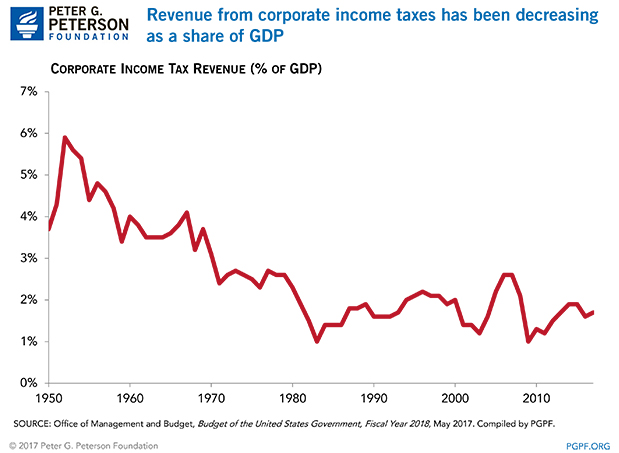

Tax collection agreements enable different governments to levy taxes. Understand your notice of assessment noa and find out how to get a copy. Income taxes in canada constitute the majority of the annual revenues of the government of canada and of the governments of the provinces of canada in the fiscal year ending 31 march 2018 the federal government collected just over three times more revenue from personal income taxes than it did from corporate income taxes.

2014 canadian tax rate tables. For 2018 and previous tax years you can find the federal tax rates on schedule 1 for 2019 and later tax years you can find the federal tax rates on the income tax and benefit return you will find the provincial or territorial tax rates on form 428 for the. 2014 personal income tax rates updated to october 1 2014 corporate income tax rates 2010 2015 updated to october 1 2014 2014 top marginal tax rates updated to october 1 2014 deferred income plans maximum annual contributions to a pension plan updated to october 1 2014.

1950 1980 individual income tax parameter married filing jointly 1950 1960 1970 1980 taxable income rate taxable income rate taxable income rate taxable income rate 0 4 000 17 40 0 4 000 20 0 0 1 000 14 00 0 3 400 0. Interest and ordinary income 49 80 capital gains 24 90 canadian eligible dividends. Tax rates for previous years 1985 to 2019 to find income tax rates from previous years see the income tax package for that year.

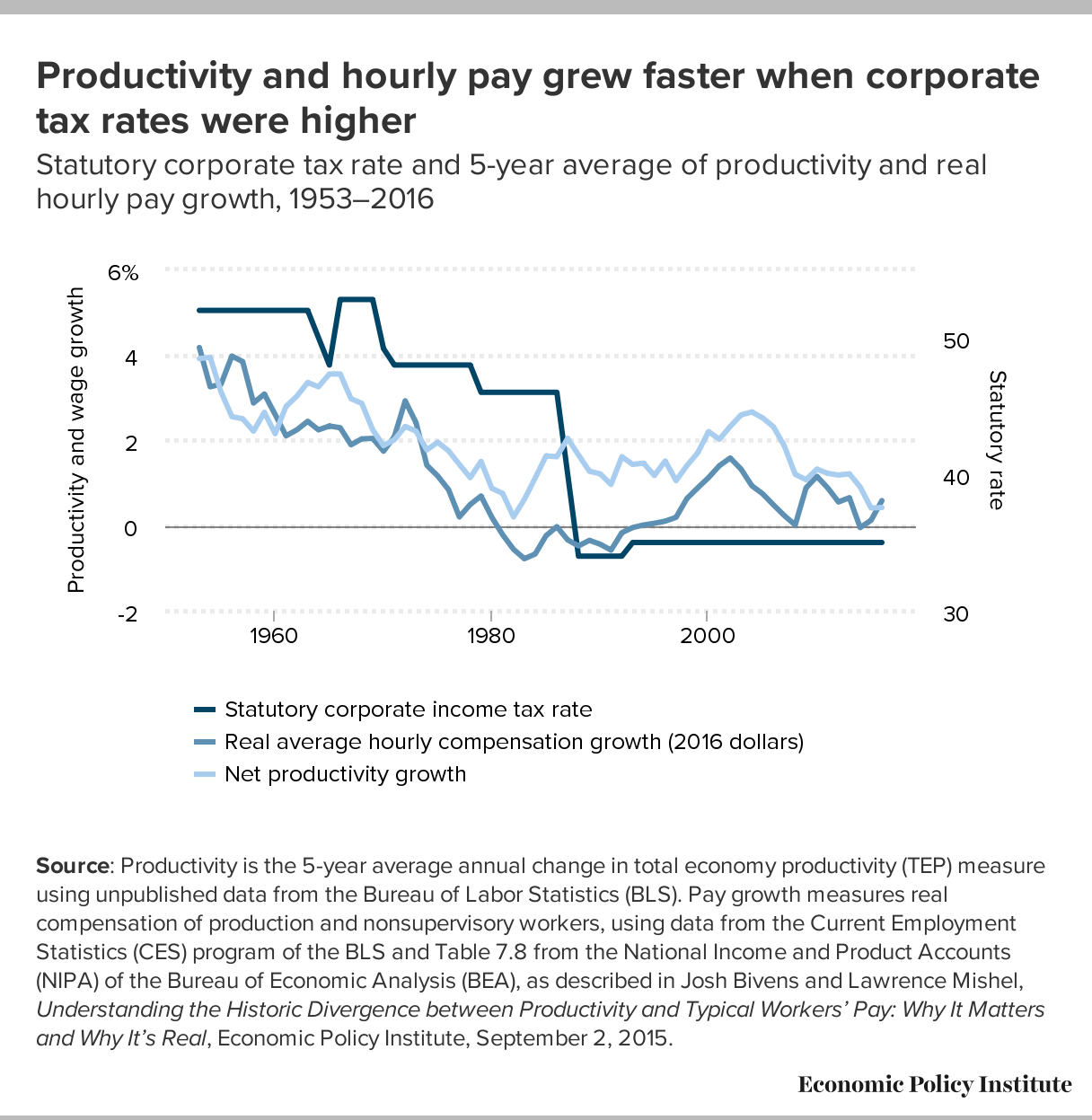

If it is not enacted the following rates will apply to taxable income above cad 214 368. Make a tax payment get information on paying by instalments paying arrears and payment arrangements. Canada s top corporations often pay far less than the official average corporate tax rate.

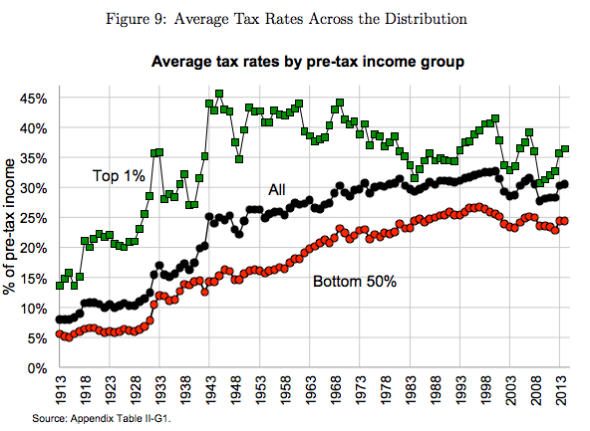

Federal income tax brackets and maximum tax rates. In 1961 families paid 33 5 of their income on taxes but by 1969 they were paying 39 and in 1974 they paid 43 4 of their income. So if you compare the 2009 effective family tax rate to 1961 you will find a 25 increase but you will only report a 7 increase since 1969 and an actual decrease since 1974.

Approximately 0 00235 of households had income taxed at the top rate.