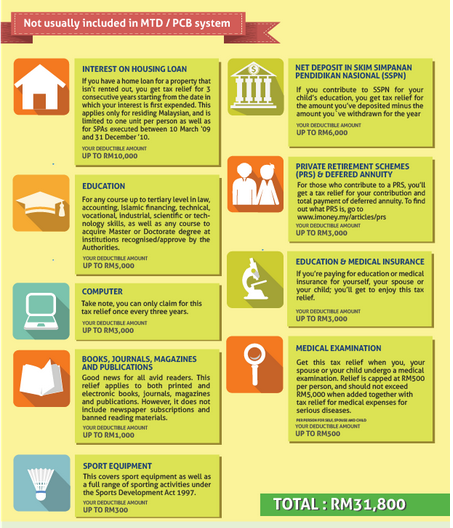

Private Retirement Scheme And Deferred Annuity Tax Relief

The tax relief entitlement makes this two planning methods even more attractive for retirement planning purpose.

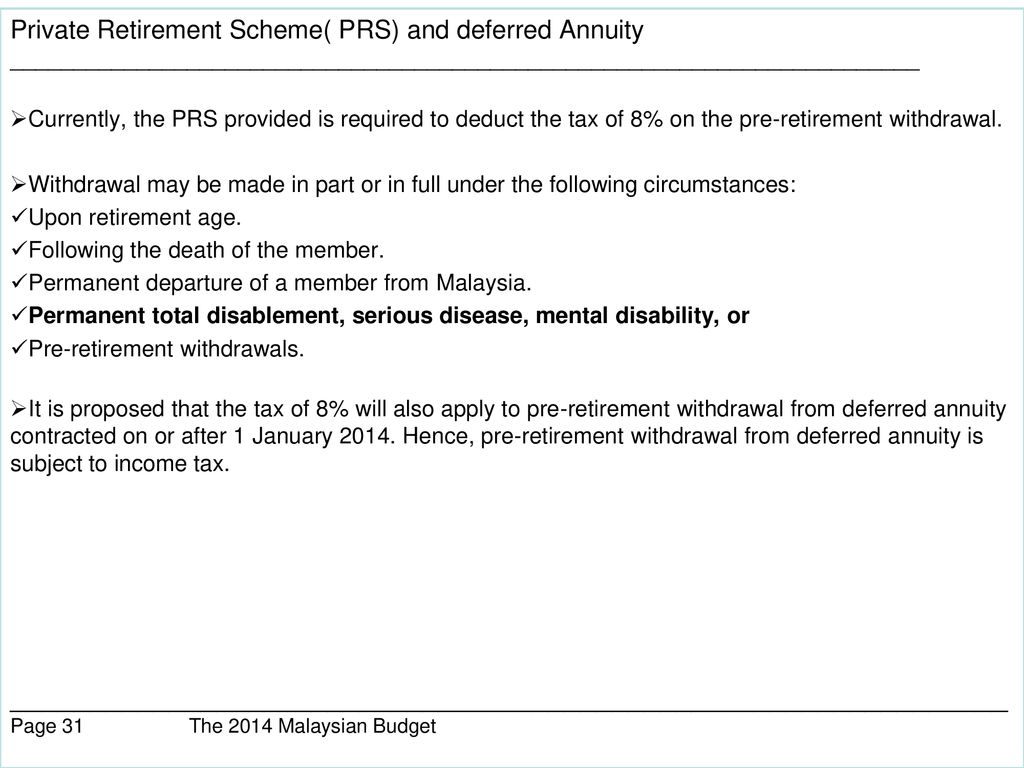

Private retirement scheme and deferred annuity tax relief. The private retirement scheme is governed under the security commission whereas the deferred annuity is governed by bank negara malaysia. It aims to grow its members savings over the long term where the accrued benefits are determined by the amount. They were also known as section 226 pensions s226 pensions or self employed retirement annuities.

Members of these schemes receive tax relief on any contributions that they make. Tax relief for resident individual. With prs there are no fixed amount of intervals or term of contribution.

Private retirement schemes prs is a voluntary long term savings and investment scheme designed to help you save more for your retirement. The managing director of sac wealth management sdn. Further to the post on contribute to the private retirement scheme to reduce your tax bill i have been often asked what is your personal preference ie.

Racs were designed to help the self employed or workers not offered a workplace pension scheme to build up retirement benefits. Deferred annuity and private retirement scheme prs with effect from year assessment 2012 until year assessment 2021. A private retirement scheme prs is a defined contribution private scheme that complements the employees provident fund epf and other retirement plans on a voluntary basis.

Prs is offered by unit trust companies whereas deferred annuity is offered by insurance companies. 3 8 private retirement scheme means a retirement scheme approved by the securities commission sc in accordance with the capital markets and. First prs is under the governance by securities commission of malaysia while deferred annuity by bank negara malaysia.

For contributions into the prs and deferred annuities effective from years of assessment 2012 to 2021. Explained some differences between private retirement scheme provided by unit trust companies and the deferred annuity plan provided by. Enjoy additional personal tax relief.

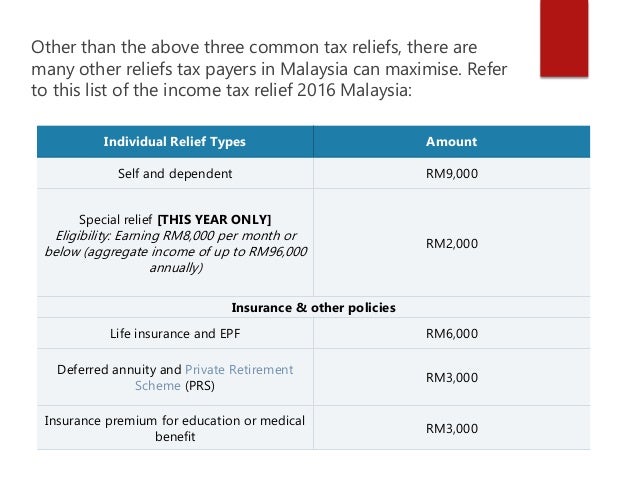

The tax deduction is effective for 10 years from the year of assessment 2012 until the year of assessment 2021. You can get up to rm3 000 personal tax relief annually on top of the rm6 000 annual tax relief for epf contribution and life insurance premiums. As you are probably aware with effect from the year of assessments 2012 to 2021 10 year period only individual taxpayers are eligible to claim a personal relief of up to rm3 000 annually for contributions to the private retirement scheme prs or the deferred annuity scheme.

Prs seek to enhance choices available for all malaysians whether employed or self employed to supplement their retirement savings under a well structured and regulated environment. Amount rm 1. We can see that these two categories share the same rm3000 tax relief.

Deferred annuity and private retirement scheme prs with effect from year assessment 2012 until year. The amount of rm3 000 is inclusive of premiums paid for deferred annuity.