Real Estate Investment Trusts Reits Australia

In the most basic of terms a real estate investment trust or reit is an investment product that gives investors exposure to property assets.

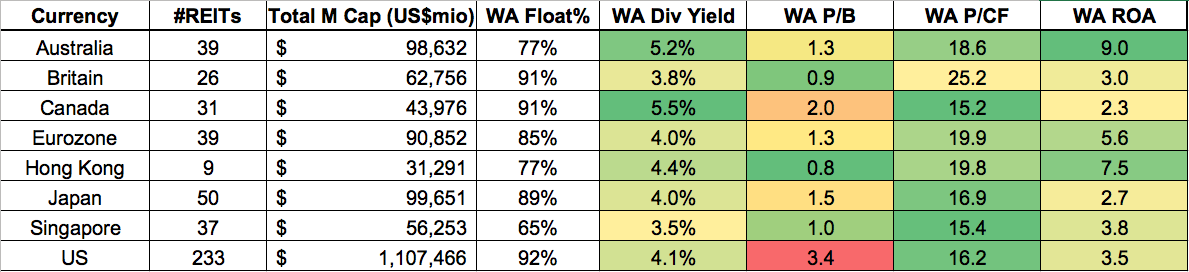

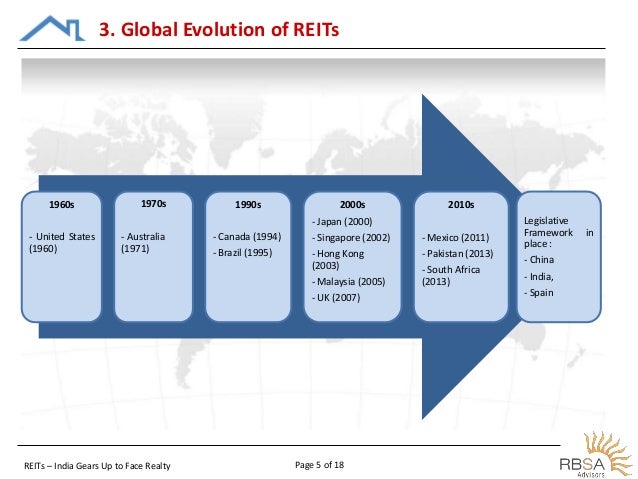

Real estate investment trusts reits australia. Some reits engage in financing real estate. Real estate investment trusts reits are exactly as they sound investment trusts that invest in real estate. Continuing the series of reference lists of real estate investment trusts reits here is.

They will own a portfolio of properties. Investors benefit from any increase in value in the underlying asset as well as from rental income generated from the properties owned. Real estate investment trusts reits in australia referred to as a reits are a way to gain exposure to property investments without needing to buy and manage the physical property.

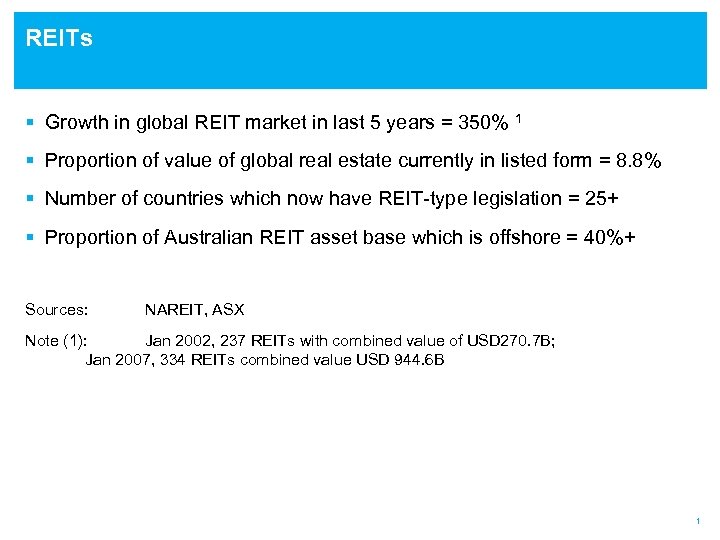

The major benefit of a reits is that they can provide access to assets that may be otherwise out of reach for individual investors such as large scale commercial properties. Different types of a reits. Australian reits are known as a reits and are publicly listed on the australian stock exchange.

Australian investors love invest in property and reits is one of the most accessible means for. A reits australian real estate investment trusts give investors access to property assets. Reits have the option to invest in property either within australia or internationally.

Reits own many types of commercial real estate ranging from office and apartment buildings to warehouses hospitals shopping centers hotels and commercial forests. Again they re simply property investment trusts which are listed on the sharemarket. You ll also see them called listed property trusts.