Rhb Islamic Credit Card Cash Back

Will be waived if cardholder spends rm10 000 in a year.

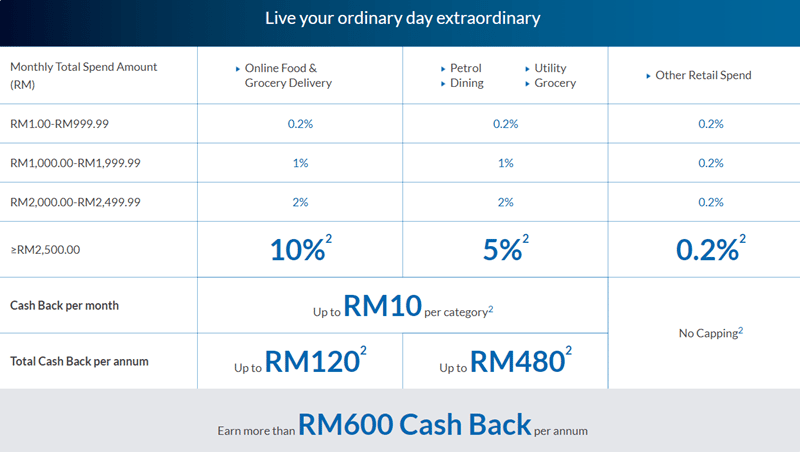

Rhb islamic credit card cash back. Rhb cash back credit card i min income rm24 000 per annum earn up to 10 cash back on your retail purchases no annual fees 1st year waived. Rhb cash back visa credit card get up to 10 cashback when you spend on petrol dining utility grocery and online food grocery delivery a credit card that meets your daily needs. Apply now up to 10 cashback.

Kindly refer to the table below for cash back by spend category. The annual fee for rhb islamic cash back credit card i is rm70 for principal card whereas free of charge for supplementary cards. Get up to 10 cash back when you spend on petrol dining utilities grocery online dining grocery delivery and other categories.

Kindly refer to the table below for cash back by spend category. Annual fee waiver for rhb islamic cash back credit card i cardholders. The conditions should not include any stipulation of a fee in the event of late payment as is the case with most of the credit or debit cards issued by riba based banks.

Interestingly rhb islamic bank is waiving the annual fee for this cashback credit card for the first year. Rhb islamic cash back credit card i. Get up to 10 cash back when you spend on petrol dining utilities grocery online dining grocery delivery and other categories.

Apply now up to 10 cashback. Rhb cash back credit card i. 20 days penalty free period.

Cash back rhb cash back credit card rewards you with great savings on your daily essentials spend. Cash back rhb cash back credit card i rewards you with great savings on your daily essentials spend. Every purchase made with rhb credit cards i can be channeled towards a greater purpose.

Balance transfer over 36 months. 2nd year onwards waived with minimum rm10 000 spend p a. Rhb cash back mastercard credit card get up to 10 cashback when you spend on petrol dining utility grocery and online food grocery delivery a credit card that meets your daily needs.

That is because making withdrawals with this card is taking a loan from the issuer and stipulating that something extra be paid back with the loan constitutes riba.