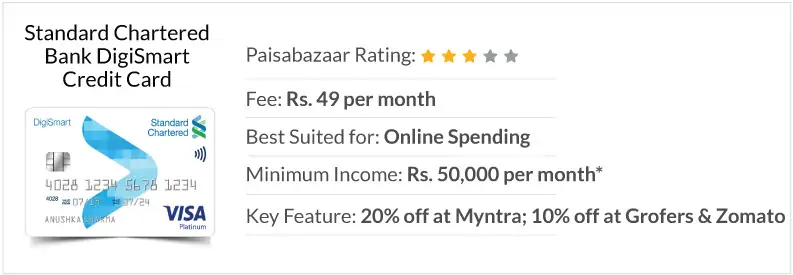

Standard Chartered Just One Annual Fee

Scb rewards points earned on the x card technically don t expire but since many weren t intending to renew the de facto lifespan was one year.

Standard chartered just one annual fee. Standard chartered bank the bank is committed to maintaining a culture of the highest ethics and integrity and in compliance with all applicable law regulation and internal policy. Unlike other cards there are no waivers or ways to get around this fee. The annual fee waiver means that those of you who still have points can wait for the next transfer promo to.

However if you are a new standard chartered customer you will be exempted from paying the annual fee for the first year. Minimum rm10 or 1 of the total outstanding balance as of the statement date whichever is higher. Previously the standard chartered justone platinum mastercard offered one of the highest monthly cashback caps in malaysia at a generous rm85.

Cashback for online only purchases will be capped at rm30 per month. However if you only need a cash back credit card for auto debeting your insurance premiums and nothing else with rm2 5k spending and cash back of rm60 this works out to 2 4. Not just plain vanilla krisflyer miles standard chartered x card members have access to 7 other airline and 2 hotel loyalty programs.

Annual fee for the principal cardholder the annual fee is sgd 695 50 inclusive of gst. Rm10 for all normal gsc ticket. Free free for life min.

Any supplementary cardholders will have to pay an annual fee of sgd 107 including gst. You can now pay with your standard chartered visa card using tap to pay contactless technology. As part of this commitment the bank has a speaking up programme through which genuine concerns in this regard can be raised.

Effective 25th november 2016 we will be introducing an annual fee of rm8 on mastercard debit card issued to justone personal saadiq justone personal i accountholders. Age for principal holder. Age for supplementary holder.

The annual fee for justone platinum mastercard is rm250. Prompt payment for at least 10 out of 12 months. First instalment is taken as the bank s fee.

No annual fee charged on supplementary cardholders. Prompt payment for 12 consecutive months. The standard chartered bank just one platinum was good because it allows those with insurance premium to earn some cash back.

Rm250 1 st year annual fee waiver supplementary card. Diva current account. There will also be an issuance fee of rm 8.

5 of the outstanding balance or a minimum of rm50 whichever is higher. Manage all your financial transactions for just one monthly fee. View all credit cards.

_flat.png?quality=70)