Tax Computation For Company

Non business income x dividend received as per p l acc x interest received as per p l acc x interest on loan to employee x add.

Tax computation for company. People with more complex tax situations should use the instructions in publication 505 tax withholding and estimated tax. Worksheets to figure the deduction for business use of your home simplified method. 2021 mar 2020 feb 2021 2020 mar 2019 feb 2020 2019 mar 2018 feb 2019.

2012 tax computation worksheet line 44 html. We have the sars sbc tax rates tables built in no need to look them up. This tax withholding estimator works for most taxpayers.

The small business tax calculator can be used to properly estimate your business tax liability refund at the end of the year. Non allowable expenses drawings cogs x holiday leave passage x bad debt specific nil general x loan to directors employees x entertainment on client x depreciation x provision of tax x proposed dividend x donation x etc x less. Indexation refers to recalculating the purchase price after adjusting for inflation index as published by the income tax authorities.

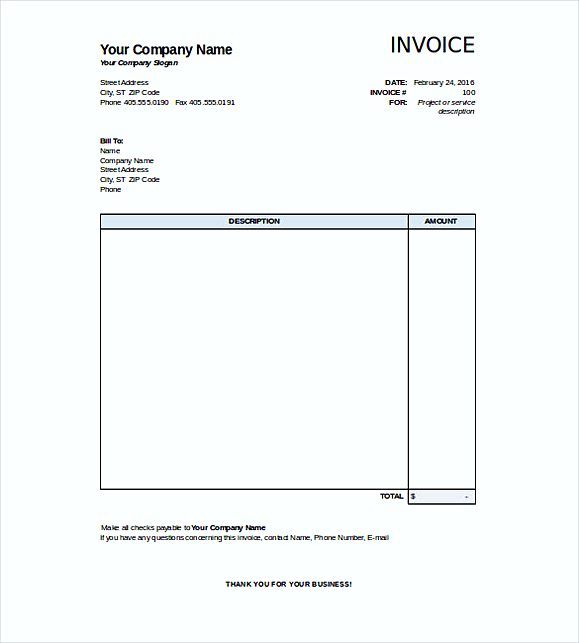

A tax computation is a statement showing the tax adjustments to the accounting profit to arrive at the income that is chargeable to tax. Special deduction nil less. 2012 tax computation worksheet.

Tax adjustments include non deductible expenses non taxable receipts further deductions and capital allowances. Last updated at may 29 2018 by teachoo. Pros that work for you tax season made easy.

Since the purchase price is adjusted for inflation the capital gain gets reduced. It is prepared taking into account different cases of expense disallowed learn more particulars amount profit as per tally xx add exp disallowed like depreciation as per companies act. This includes taxpayers who owe alternative minimum tax or certain other taxes and people with long term capital gains or qualified dividends.

Indexed cost of acquisition cost of acquisition cii for the year of transfer. Income tax computation format for companies. Calculate your business taxes to help structure your finances for a seamless tax season.

Use our small business corporation income tax calculator to work out the tax payable on your business taxable income.