Tax Relief 2019 Malaysia Lhdn

Parent limited 1 500 for only one mother limited 1 500 for only one father.

Tax relief 2019 malaysia lhdn. 30 jun 2020 merupakan tarikh akhir untuk penghantaran borang be tahun taksiran 2019. This voluntary disclosure can be made at the nearest irbm office commencing from 3rd november 2018 until 30th september 2019. Tax administration diagnostic assessment tool tadat association of tax authorities in islamic countries ataic.

6 000 limited disabled individual. Headquarters of inland revenue board of malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor. However budget 2019 made adjustments and separated them in a move to encourage more people to sign up for life insurance as protection.

In prior years of assessment the tax relief was rm6 000 combined for both items. 3000 limited basic supporting equipment for disabled self spouse child or parent. Tax reliefs are set by lhdn where a taxpayer is able to deduct a certain amount for money expended in that assessment year from the total annual income.

Tax relief year 2019. Payment of tax due if any should be made on or before 30th june. It is to encourage taxpayers to make voluntary disclosure in reporting their income to increase tax collection for the country s development.

Medical expenses for parents. Mytv tv digital dtt using dvb t2. Your email address will not be published.

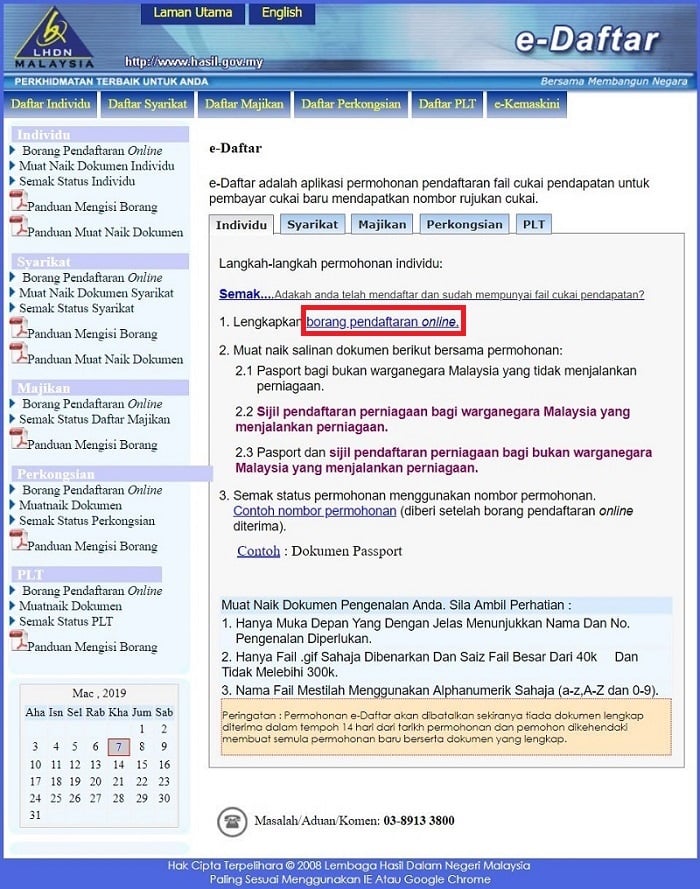

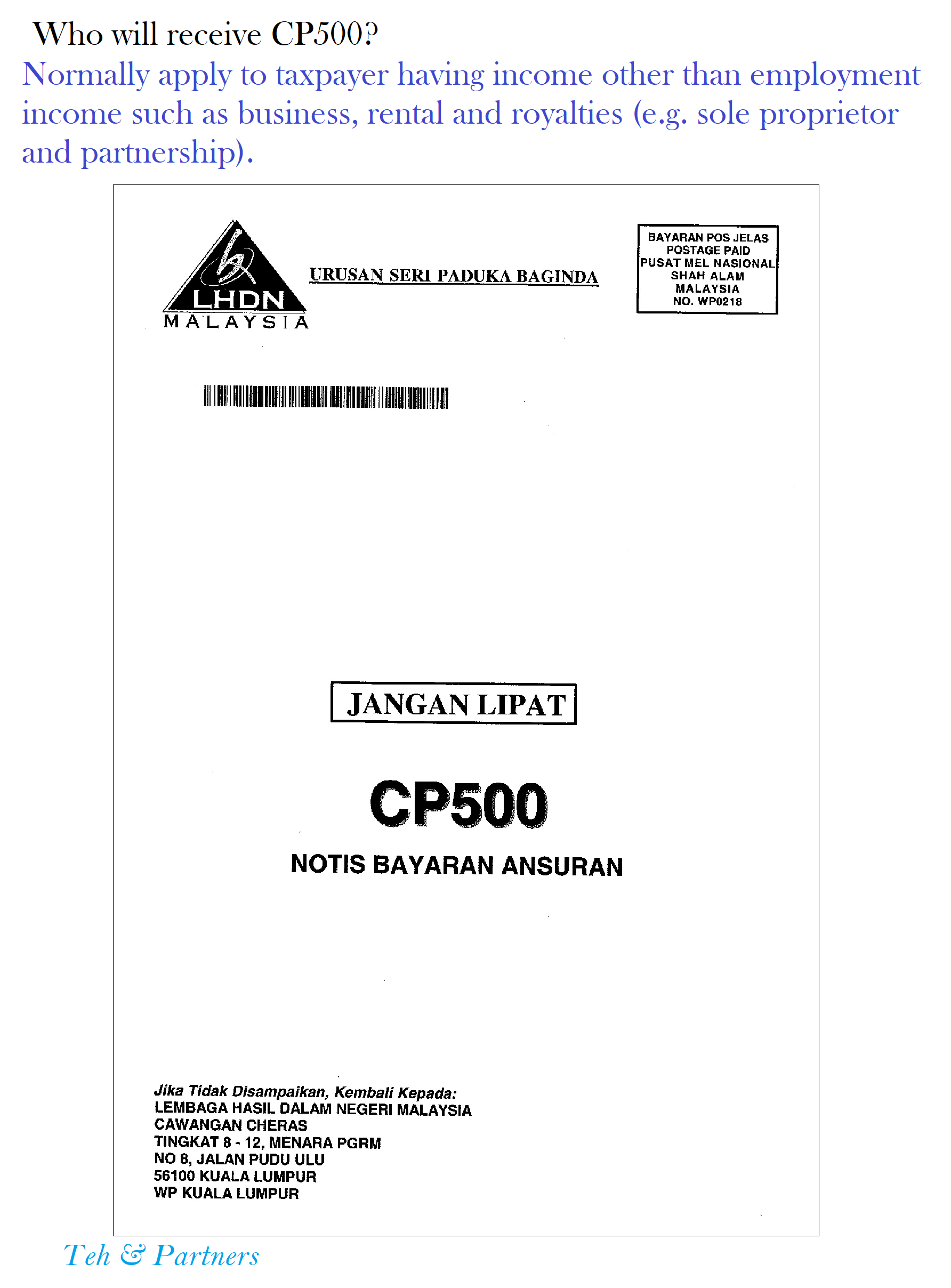

To comply with the installment scheme cp500 link. Klik ezhasil dan pilih e filing. This relief is applicable for year assessment 2013 and 2015 only.

Lembaga hasil dalam negeri malaysia inland revenue board of malaysia. This special program is part of the government s efforts in tax reformation. For income tax filing in the year 2020 ya 2019 you can deduct the following contributions from your aggregate income.

Malaysia lhdn tax relief and rebate for individual. Amount rm self and dependent. Medical expenses for parents.

From year of assessment 2020 not applicable for 2019 2018 2017 couples seeking fertility treatment such as in vitro fertilisation ivf intrauterine insemination iui or any other fertility treatment approved by a medical practitioner registered under the malaysian medical council mmc can also claim under this income tax relief in malaysia. Amount rm 1. 04 11 2016 leave a reply cancel reply.

Mudah tepat dan selamat. 5 000 limited 3. Malaysia income tax deduction ya 2019 explained a tax deduction reduces the amount of your aggregate income which the sum of your total income for the year put together.

2019 27 411 904.