Travelling Allowance Subject To Epf

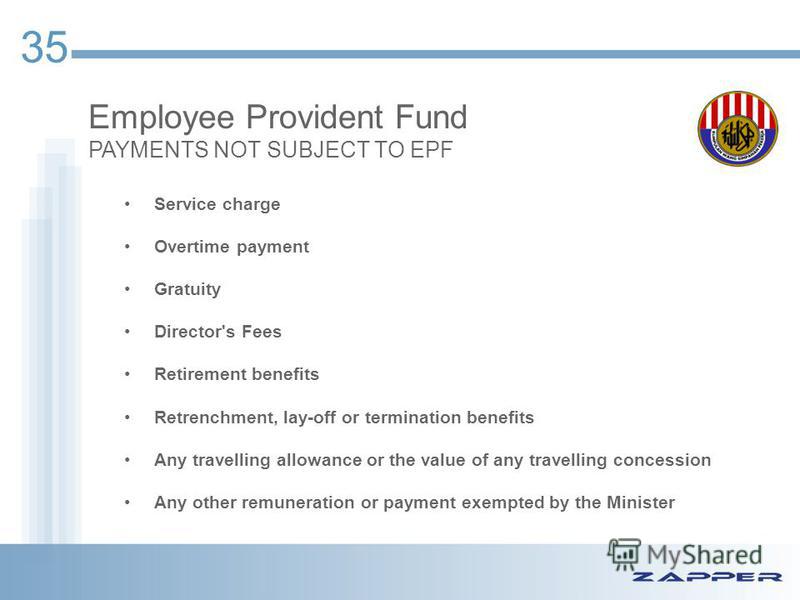

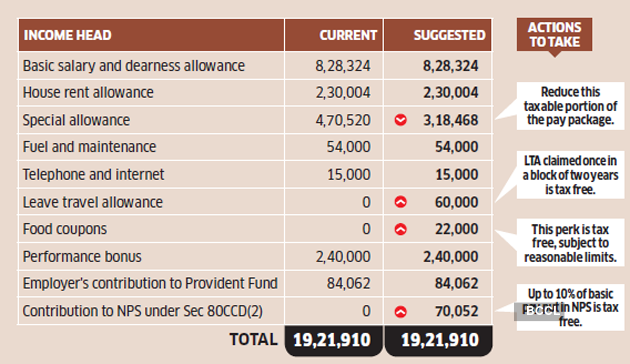

Any traveling allowance or the value of any travel concession any payment paid by an employer to an employee for the purpose of travelling and transport expenses.

Travelling allowance subject to epf. Payments exempted from epf contribution. Gratuity payment to employee payable at the end of a service period or upon voluntary resignation retirement benefits. If the amount received exceeds rm6 000 a year the employee can make a further deduction in respect of the amount spent for official duties.

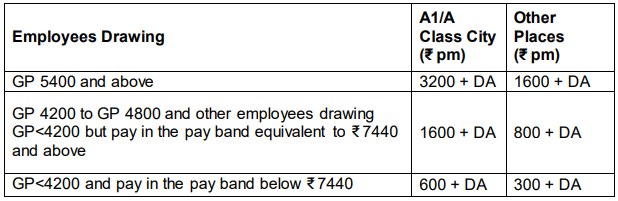

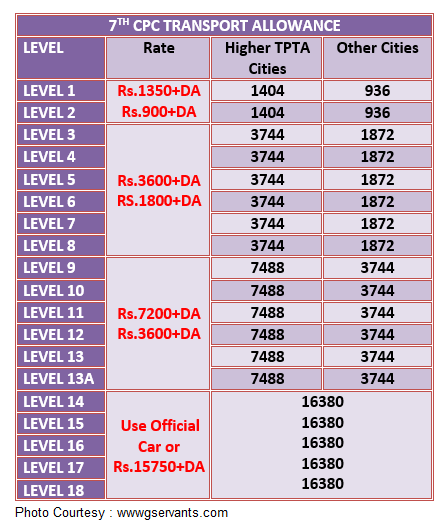

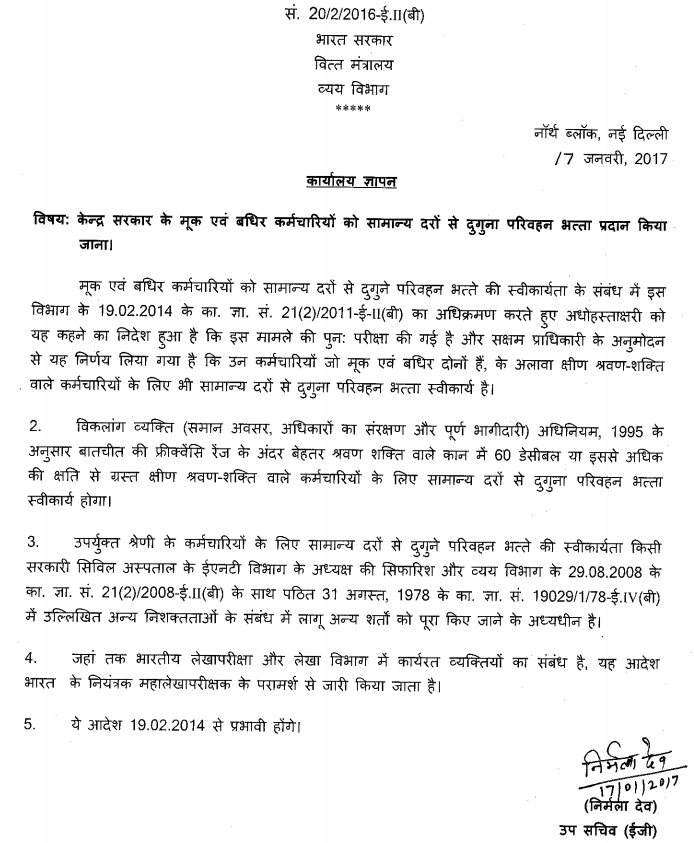

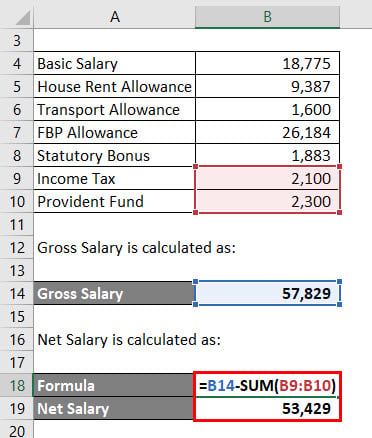

Of epf and socso allowance. Employers are legally required to contribute epf for all payments of wages paid to the employees. The payments below are not considered wages by the epf and are not subject to epf deduction.

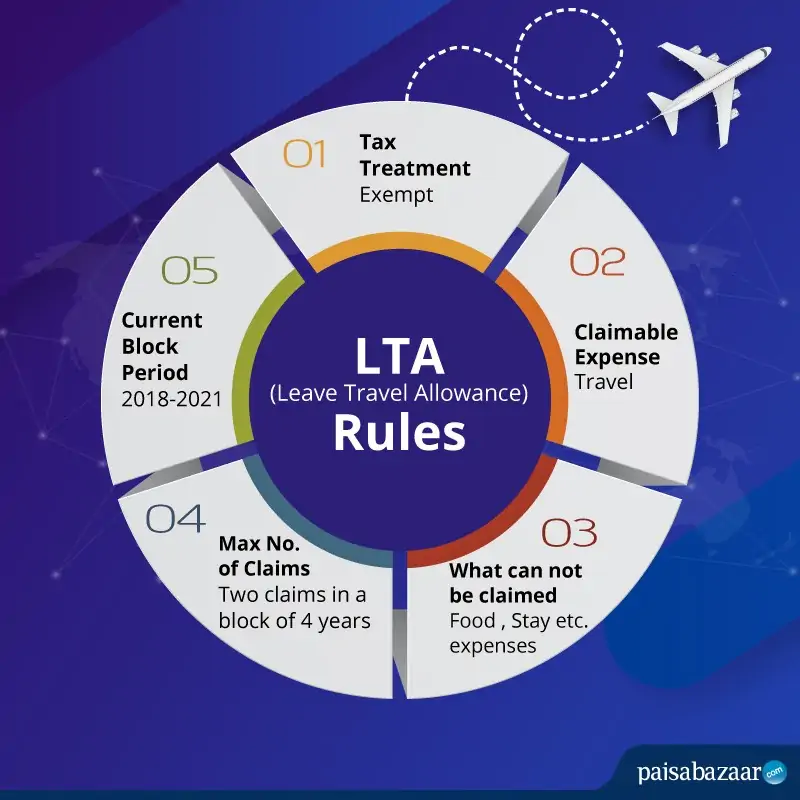

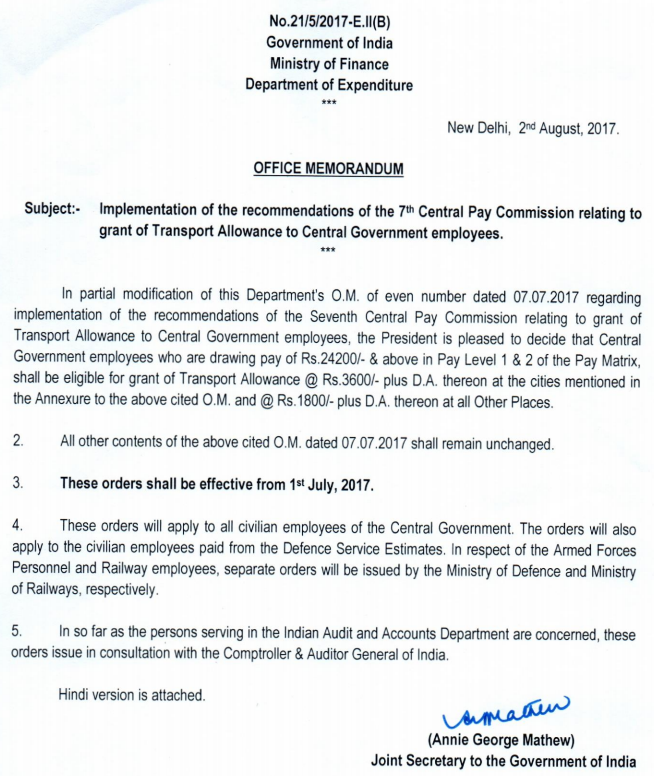

Rest days and public holidays reimbursement for travel from home office to the place of assignment not the normal place of work. These contributions comprising the member s and employer s share will be credited into the member s epf account. Reimbursement for travel in the line of official duty reimbursement for travel between home and workplace beyond normal working hours e g.

Any traveling allowance or the value of any travel concession any other remuneration or payment as may be exempted by the minister for further information refer to epf act 1991. Subject exemption limit per year no. Subject exemption limit per year 1.

Epf members in the private and non pensionable public sectors contribute to their retirement savings through monthly salary deductions by their employers. Allowances subjected to socso deductions would include allowances payable by an employer to the employee but excludes travelling allowances or the value of any travelling concession and any sum paid to an employee to defray special expenses incurred as a result of his employment. Rate of contributions the current rates are 11 for the employee and 12 for the employer but employers are advised to keep abreast with changes which may take place from time to time.

Petrol card petrol allowance travelling allowance or toll payment or any of its combination for official duties. However as the word is broad enough to include payments for food clothes accommodation phone calls etc reference can be had to case law to ascertain its scope. Among the payments that are exempted from epf contribution.

Epf deduction for travelling allowance was created by siti noratikah rosli hi i would like to understand for the epf deduction all allowance need to make contribution except the travelling allowance. Allowance allowance except travelling allowance is included in the definition of wages under the epf act.