Uob Fixed Deposit Rate For Senior Citizen

Most of the banks as well as the non banking financial companies or nbfcs provide preferential extra fd rates to senior citizens at an extra rate of 0 25 1 00 approximately.

Uob fixed deposit rate for senior citizen. If you are their priority banking customer you can get a preferential rate of 0 60 p a. They prefer to invest a large amount of their money in bank fds because the principal investment amount is considered safer as compared to investments in equity and the former also offers assured return in the form of interest income. Above the interest rates for a 6 9 12 18 24 or 36 month fixed deposit.

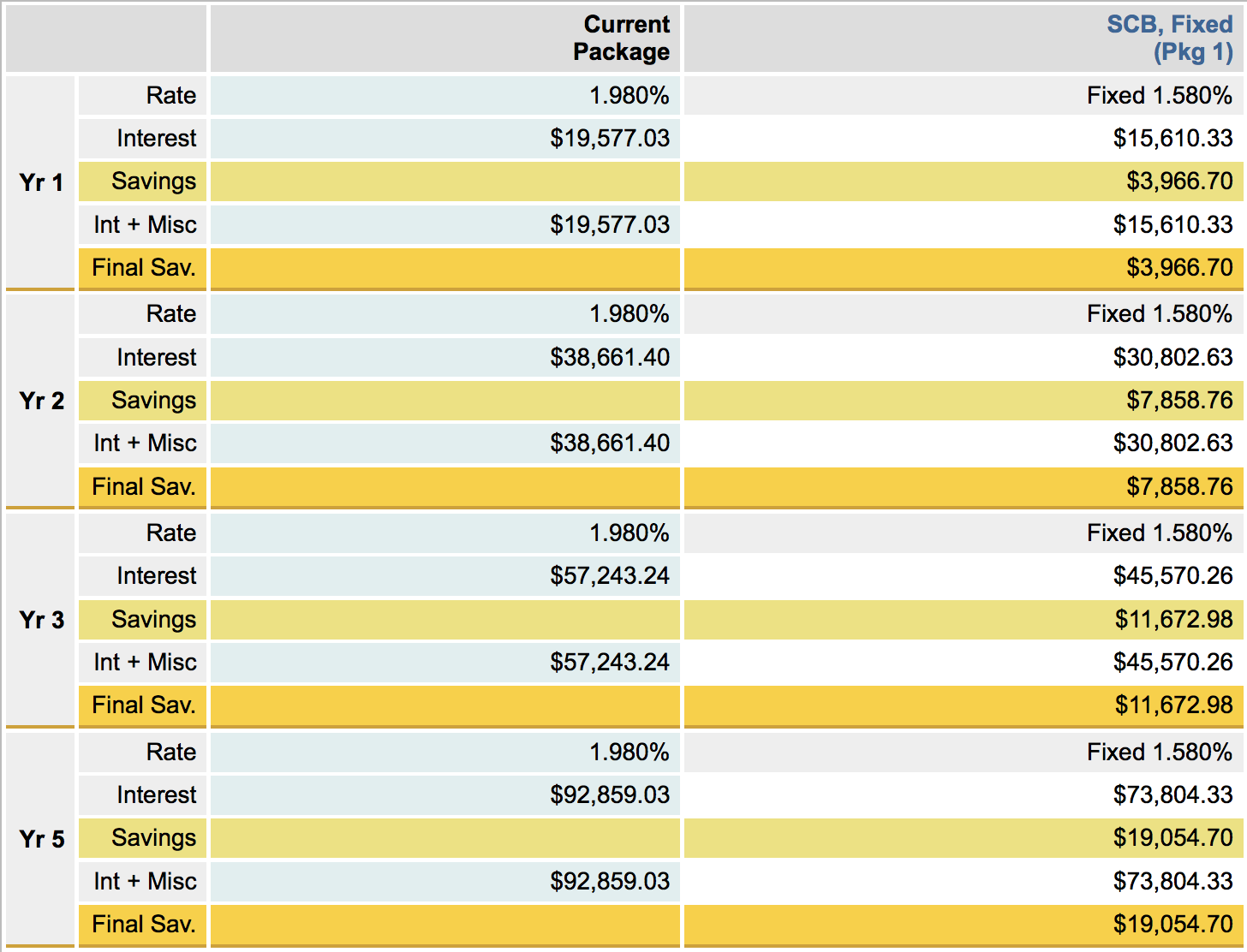

6 month with standard chartered time deposit. For deposits maturing in one year to 699 days the interest is 8 25. The promotional interest rate will only apply if the fixed deposit is held to maturity.

If the fixed deposit is withdrawn before its maturity no interest will. Up to 0 90 10mo s 20 000 min deposit uob singapore dollar fixed deposit offers some of the market s highest interest rates for small to moderate s 50k sized deposits with longer tenures and also comes with an attractive promotion. Currently the highest senior citizen fixed deposit rate is 9 50 which is offered by fincare small finance bank.

The senior citizen may avail the tax benefit wherein no tds will be charged if the senior citizen does not earn rs. Standard chartered sgd fixed deposit. They usually earn 0 25 to 0 75 higher interest compared to regular deposit rates for tenures ranging between 6 months to 10 years.

Senior citizen fixed deposit rates as on sep 2020 senior citizens aged 60 years or more are offered a higher fixed deposit interest rates by banks as compared to general public. For senior citizens fixed deposit fd is one of the most common financial instrument to invest their money. The minimum placement is s 25 000.

However if the senior citizen earns more than rs 50 000 per year then the bank will charge 10 tds on the entire interest and if the investor fails to provide with the pan details then 20 for the same will be charged. Fixed deposits prove to be a good choice for senior citizens who have low or irregular income. The fixed deposit must be made with fresh funds and not funds transferred from existing uob savings current fixed deposit account s or uob cheques cashier s orders and demand drafts.

Grand senior citizens fixed deposit grand senior citizens fixed deposit account allows the customer to enjoy an extra interest of 0 125 p a.